The modern CFO war

(6 Minute Read Time)

As a CFO or FD, Finance Manager or other finance professional, do you know you're at war?

When asked, Lord Sorrell, British businessman and the founder of WPP PLC, the world's largest advertising and PR group stated: "The tragedy of COVID-19 has only accelerated the speed of digital transformation and disruption."

“It’s not like the dot-com bust, it’s not like 9/11, it’s not like the great financial crisis; it’s most like war.”

He’s right. This is an age of war-like chaos. In the next year, fortunes will be made and lost and the CFO and Finance professionals are front and center of supporting the business through tough times and allowing the organisation to cash in on new opportunities.

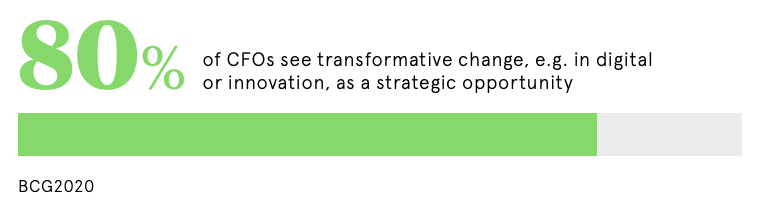

As industries re-invent, at the heart of it all, are CFOs. And for companies that need a new business model, again the CFO is the mastermind.

For some lucky enterprises, it’s about managing explosive growth. The online crafts and hobbies website LoveCrafts saw visitors increase 266 percent between March and August 2020, as consumers were stuck at home. Its beginner’s guide to crafting for newbies grew by 6,499%! It’s a once-in-a-lifetime opportunity.

In less fortunate sectors, the CFO is leading the fight for funding. Who else could navigate the Coronavirus Business Interruption Loans Scheme or the Bounce Back Loan Scheme? There will be hard conversations with landlords, with creditors / suppliers and so on.

The role of technology

Technology, naturally, will have an impact on which CFOs perform. Cloud systems help with scale. Cloud-hosted accounts eliminate issues around capacity. Software scales up and down as needed. A spike in purchases can be handled smoothly. Plus, the finance team can log on from anywhere with a cloud system, which is ideal for secure home working, which became a necessity and in the future will become a part of normal working life. Cloud is a technology tailor-made for the present and future economy.

Automation too is critical. When budgets are tight, it’s vital that drudge work is handed over to machines. Invoice-chasing, payroll and expenses management must be automated. The finance team want to focus on strategy, not data entry.

When the board depends on business intelligence, again it's the job of the CFO. Dashboards and reports can be auto-generated by the right technology, giving each department exactly the numbers they need, updated as often as required.

And costs must be driven down. The arrival of artificial intelligence, machine learning and the cloud can cut costs in the financial sector by 30 to 50 percent, according to the Bank of England.

So a move to embrace technology is vital for future success. What’s the secret? One company seems to know. Moneypenny is a virtual personal assistant service. Its pool of PAs answer your calls, manage your diary and much more. And each year Moneypenny posts 20 percent growth with the consistency of a metronome. In 2005, it was a £2-million-a-year company. Today it’s over £50 million with a thousand staff servicing 20,000 clients. But behind it all, is the Finance department and CFO Mark Williams.

Talking about the move to cloud technology, Williams says: “Lockdown proved how important it is for people to be able to log on and do their work via a web browser. The cloud allows this. It also means third-party integrations are easier. Plus there’s no maintenance downtime or costly upgrades with cloud services. You always get the latest version as upgrades are rolled out, without you needing to do anything."

“Back in 2005 when I joined, I had 4 people in my team,” he says. “Now our client base is many times larger, but we have just 10 people in Finance. It’s down to our focus on efficiency. The moment a task is repetitive, it is the next candidate for automation.”

Security is important too. Moneypenny’s clients expect confidentiality and a breach is costly. Fortunately, cloud-based systems can be more secure than on-premises software. Lloyds Bank, for example, is migrating its core banking platform to a cloud provider. Data is encrypted at source and in transit - in what is known as cloud-native software design, a major upgrade on old-fashioned IT perimeter defences.

Monzo, Britain’s fastest-growing bank with 4.2 million customers, already bases operations entirely in the cloud. It’s a sign of the times.

When looking at best-in-class cloud financial management, a true-cloud solution like Sage Intacct is purpose-built to provide enhanced organisational efficiency and performance.

With a low total cost of ownership, where customers achieve an average ROI of 250% and payback in less than 6 months - Sage Intacct delivers open integration to other cloud systems, for deep integration and success.

Learn more about cloud financials here

Or register for a short 20-minute coffee break demo of leading cloud finance solution - Sage Intacct