Nonprofit's are changing

(6 Minute Read Time)

In nonprofit organisations the finance operation viewpoint is changing. Long gone are the days of finance simply keeping score of a nonprofit organisation's performance. Historical reporting no longer meets the grade and finance leaders need to assume a more strategic role in organisational insight and planning.

To do that, there is a need for better visibility into both financial and operational metrics, so nonprofits can make better decisions. In turn, executives must be able to leverage every insight from the data to better support the mission in an ever-changing environment.

This begs the question: how?

In an effort to deepen strategic impact from finance, there is a strong push to improve the efficiency and the effectiveness of finance.

Seek process automation. Deepen and widen visibility. And add the ability to easily adapt. Powerful integration, real-time insight and flexible reporting therefore is a top priority for nonprofits.

Often in hand with this is a desire to replace an underperforming financial management solution that simply cannot meet these demands. The right financial management and reporting solution can be a critical driver of efficiency and visibility; the wrong solution can become a roadblock to improvement.

That said, nonprofits often have limited IT resources. But ultimately the benefits and future strategic direction, need to outweigh the challenges and costs. To highlight this we have compiled a list of 10 symptoms of inadequate financial reporting often seen in nonprofit organisations:

- Reporting only looks backward because there's a lack of ability to see the right now. When surveyed - 57% of nonprofit finance professionals believed lack of real-time visibility into KPIs slowed their ability to make decisions

- When creating a finance reporting pack, this requires first manual manipulation of the data in another tool, such as a spreadsheet to make it presentable. This is time-consuming and concerned 64% of nonprofit finance professionals

- Executives ask for lots of ad-hoc or special reports but don’t receive them in a timely manner. At the same time, the finance team is working harder than ever

- The lead up to board meetings is chaotic and stressful for the finance team and executives. Preparation may involve more manual data manipulation - time that could have been spent more strategically

- Systems are poorly integrated, creating the need for duplicate data entry. Nearly six in ten (57%) nonprofit finance professionals felt multiple, disconnected systems cause inefficiency

- Department or programme managers have created their own reports, outside the accounting and financial management system. Almost half (48%) of nonprofit finance leaders said their staff understood the financial health of their own programmes but lacked awareness of the overall organisation’s financials

- Reports contain revenue and expense information but no operational performance or outcomes. In fact, 60% of nonprofits felt moderately or highly challenged by the lack of a consistent framework for measuring and reporting impact

- Poor internal controls or inadequate reporting place grants and donations in jeopardy. Donors want to see impact and compliance. That’s why 61% of nonprofits recently received funder requests for more information about impacts and outcomes

- Lack of project accounting functionality impedes management capabilities. Programme managers need to be able to allocate expenses and revenue across programmes and see real-time performance metrics and budget-to-actuals for their programmes

- Inability to view consolidated, multi-entity reporting deprives executives of vital visibility. In multi-entity nonprofits, programme staff need granular details, but the leaders often prefer a rolled-up financial picture. A good reporting system should provide both

Financial management in the cloud overcomes and delivers across these areas, improving efficiency (so organisations can do more with less) and gaining visibility (so executives can better lead the mission).

Making the finance team a key strategic partner within the organisation.

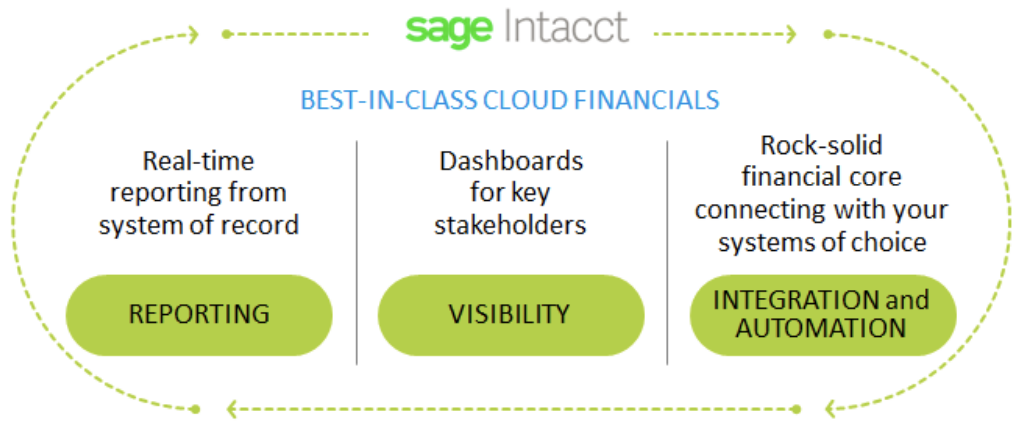

When looking at best-in-class cloud financial management, a true-cloud solution like Sage Intacct is purpose-built to provide easy and customisable reporting, that drills down to the smallest detail but can also roll up multiple entities for a complete view of organisational performance.

With a low total cost of ownership, where customers achieve an average ROI of 250% and payback in less than 6 months - Sage Intacct delivers real-time, dimensional reporting of both financial health and operational outcomes. And with open integration to other cloud systems, deep and wide strategic visibility is possible.

Learn more about cloud financials for nonprofit organisations here

Or register for a short 20-minute coffee break demo of leading cloud finance solution - Sage Intacct